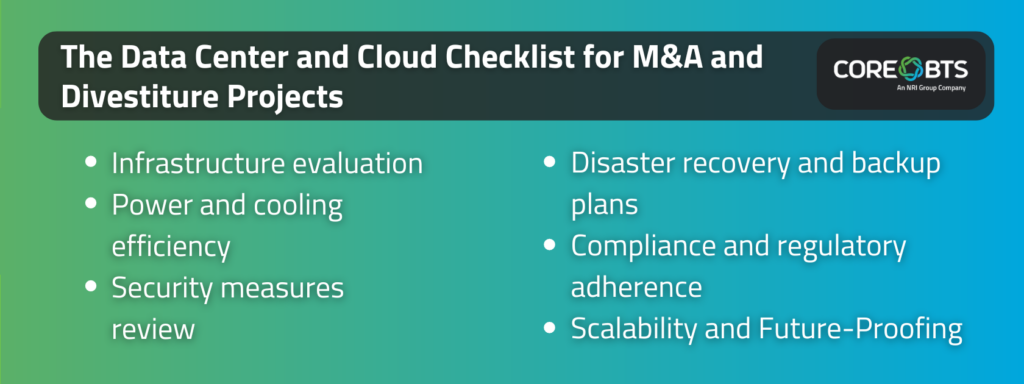

Discover the essential components of a comprehensive data center assessment and how to ensure your new infrastructure meets current and future business needs.

Expanding your organization’s capabilities and footprint through mergers and acquisitions (M&As) and divestiture projects can be game-changing, but careful attention to technology from the outset is crucial. Your approach to these transactions must prioritize technological integration to ensure a seamless transition and operational continuity.

Technology due diligence is among the top considerations—perhaps even the most important. Technology acts like a business’s central nervous system, so ensuring that all the parts sync between the businesses joining the M&A or divestiture project is critical to forming a healthy new organization. It only takes a single IT mishap for everything to go sideways.

To that point, IT shouldn’t be an afterthought.

This guide covers all critical aspects of a robust data center assessment, from evaluating physical infrastructure and power usage to assessing security measures and disaster recovery plans. Let’s jump right in!

1. Infrastructure Evaluation

Understanding the composition of your tech stack is imperative. So start by taking stock of your data center’s digital and physical assets, including cooling and power systems, cabling, rack configurations, storage solutions, and network setups.

A detailed inventory reveals many crucial aspects, such as:

- The functionality and condition of hardware and software

- Whether the data center has adequate redundancy and resources for current and future needs

- Whether server layouts provide optimal airflow and cooling

- Which areas require changes or upgrades

As a result, you can intervene early to minimize the risk of equipment failure, reduce operational and maintenance costs, and efficiently support business growth.

2. Power and Cooling Efficiency

According to the International Energy Agency (IEA), data centers use about 1-1.5% of the world’s electricity. Much of that consumption is caused by inefficient facilities plagued by poor power and cooling systems, lackluster design, limited oversight, and inconsistent processes.

Not only do inefficient data centers increase utility bills, but they also cause other negative impacts like:

- Overheating

- Outages

- Downtime

- Data loss

Auditing the data center’s performance using a metric like power usage effectiveness (PUE) can reveal potential ways to optimize energy usage. By closely examining power use, lighting levels, and the thermal environment, the audit can uncover hidden insights such as incorrect HVAC settings, malfunctioning equipment, and lights being left on in unoccupied/unused spaces so you can curb waste and costs.

3. Security Measures Review

Robust security is a must in today’s high-stakes threat environment. Without it, attackers will easily breach your organization and access critical assets. When that happens, you risk losing sensitive data, brand reputation, customer satisfaction, and potentially millions in regulatory fines.

Conducting a rigorous security audit for M&A and divestiture projects is the best way to evaluate the strength of existing capabilities. It also helps you avoid inheriting vulnerabilities, lagging policies/controls, and other undesirable aspects post-close.

In your audit:

- Catalog and evaluate the effectiveness of identity and access management controls, cloud, application, network, endpoint, and data security tools

- Examine physical access controls protecting facilities and technology assets

- Scrutinize how the target organization enforces, monitors, and manages vendor and third-party privacy, security, compliance

- Search for previous and active breaches and ask about the steps taken to contain them and prevent them from recurring in the future

As you review security measures, also consider how you’ll ensure business continuity.

4. Disaster Recovery and Backup Plans

It pays to be prepared for natural calamities, malicious attacks, and other unforeseen contingencies. A robust incident response plan ensures your organization doesn’t experience prolonged downtime or lose money and critical data when disaster strikes.

On average, downtime costs between $9,000 per minute and $5 million per hour. To avoid this hefty price tag, review and validate the dependencies, capabilities, response plans, and backup procedures for restoring services during outages as part of your due diligence. Based on these, examine how quickly your business can bounce back from a significant incident and determine whether it’s within your risk tolerance.

5. Compliance and Regulatory Adherence

Compliance is another crucial item to consider in your data center and cloud checklist for M&A and divestiture projects.

Depending on your industry and market’s geography, you may be subject to HIPAA, GDPR, CCPA, PCI DSS, or other data protection regulations. Breaching these requirements is expensive. For example, a GDPR violation can attract a penalty of more than $20 million. The costs can be higher if regulators close your business or customers decide not to trust you.

Determining all applicable regulatory, legal, and industry requirements and conducting an audit to verify compliance can ensure change doesn’t negatively impact your bottom line. It will also help you better understand the strengths and weaknesses of the existing data governance framework and how to improve it.

6. Scalability and Future-Proofing

Today, the only constant in tech is change, and businesses must move quickly or risk going the way of the dinosaur. Without a flexible infrastructure, your business will stagnate and lose market opportunities. Moreover, embracing innovative and game-changing upgrades will be more challenging.

As such, you must ask whether the current infrastructure can keep up with changing needs and technology. If the answer is no, consider an alternative approach, like adopting a modular hybrid cloud infrastructure.

Do More With a Hybrid Cloud Infrastructure

Core BTS helps leading organizations transform their data centers’ capabilities without disruption. Our modular hybrid cloud solutions help you:

- Simplify your infrastructure for more resilience

- Stay secure from the core from day one

- Keep budgets in check through better cost predictability and lower cloud spend

- Protect the bottom line by eliminating outages, data corruption, and hardware failures

- Become nimble and quickly evolve capabilities as new technologies emerge

Explore CoreAIR for in-depth insights into where your company’s data and application infrastructure stand today. Let us help you chart the path forward with a new digital core.

Share on