If you’ve ever been through a company merger or acquisition, you know it’s not always a smooth experience. Regardless of the size of your company, there are many things that can go wrong. To help you plan ahead, we’re going to cover several common challenges that organizations often face during mergers and acquisitions (M&A), as well as the steps we recommend you take to help avoid and overcome them.

Common Challenges of Mergers & Acquisitions

1. Technology

Technology decisions are one of the most obvious and biggest challenges of the M&A process. Each company will have specific technological requirements that they need to consider. Following an M&A deal, it’s likely that you will have different platforms or applications that perform the same function. You will have to decide which ones will be implemented across your organization, and which ones will be retired. In addition to choosing which platforms and apps your company will use moving forward, you may also need to consider upgrading your hardware. If your operating system is older or outdated, it may be unable to support the technology you’ve chosen.

While there are several logistical, financial, and functional factors to consider when choosing which technology path to pursue, any change is also likely to cause discomfort for some percentage of the employee base who will have to give up the legacy system they know (and possibly love) to learn a new one.

2. Adoption

The technical challenges that come with M&A are only part of the equation. Another factor that needs careful consideration is adoption. One of the major reasons mergers and acquisitions fail is inadequate consideration of the full impact technology changes will have on stakeholders and the broad employee base. These impacts go far beyond simply needing to learn new technology. If your employees are unable (or unwilling) to adjust and adopt the new practices, technologies, and initiatives that come from an M&A, it will be very difficult to be successful.

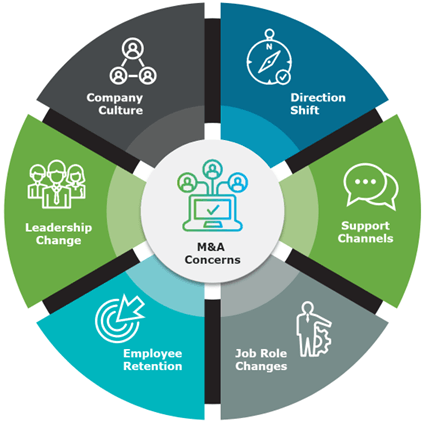

An impending M&A transaction can surface understandable concerns from employees, like:

- Does this mean I could lose my job?

- Will I be reporting to someone new?

- Will there be changes in leadership or company culture?

- Will the direction of the company be changing?

Concerns such as these can lead to disengagement, increased stress, and productivity loss amongst staff (usually from the acquired business) – all of which have been shown to affect employee retention and cost the acquiring company money. A 2019 study estimated that $500 billion in productivity are lost due to stress in the workplace. The same study also estimated that $605 billion were lost from deceased productivity associated with employee disengagement.

3. Tenant Coexistence

M&A usually includes a period of time called “tenant coexistence”. This refers to a timeframe during the post-merger integration where different groups of employees will be required to use multiple tenants at once. That coexistence timeframe is particularly disruptive and comes with its own unique set of challenges, including:

- Dual Tenant Disruption: When employees are using multiple tenants, there are often breakdowns in the communication process. Multiple email accounts can lead to confusion and the inability to rely on technology to know if someone is online or offline. This causes a disruption in what used to be a simplified stream of communication and collaboration.

- Staggered Move Dates: During tenant coexistence, the dates scheduled to migrate employees and hardware to the primary tenant will be staggered. This can breed confusion amongst staff and needs to be properly managed to ensure a smooth transition and experience for users.

- Generalized Uncertainty: Through this period, it’s common to encounter both active and passive resistance to the implemented changes. Getting buy-in from the people who will be most impacted by the changes is imperative. To do this, timing is everything.

Solutions to Mergers & Acquisition Challenges

1. Discovery Timing

In M&A, timing matters. With any M&A transaction, part of your initial due diligence should include a discovery phase. The most effective approach is to conduct the people and culture discovery either before or at the same time as the technology discovery. The results you gather from your people and culture discovery should inform and influence the technological implementation. It’s also important to continue to evaluate and validate decisions throughout each phase of the project.

2. Gap Analysis

Next, we highly recommend that you run a gap analysis. This will compare the current state of your organization with your ideal state – highlighting shortcomings and opportunities for improvement. This will make it easier to prepare a roadmap for implementation.

3. Communication Plan

Once you have a roadmap, it’s essential to create a plan for how you will be communicating the upcoming changes to those who will be affected. Sending communication on multiple dates and through various channels (email, Teams, Slack, Yammer, meetings, etc.) will ensure that the information is reaching the intended audience. This will help alleviate the uncertainty and stress felt by staff during the integration process.

4. Training Plan

Much like communication, we also recommend that you create a plan for multiple staff trainings. Having more than one opportunity to attend training sessions will increase the number of staff who complete it, and they will subsequently be that much more prepared when they are asked to use the new system(s). Additionally, providing employees access to a Frequently Asked Questions (FAQ) list will help alleviate common issues as the transition begins.

5. Change Champion Program

Finally, although having decision makers on board is important, ensuring that employees at all levels of the organization believe in the new initiatives will be instrumental in overcoming cultural differences and achieving a more seamless transition. One of the most effective ways of increasing employee adoption is by implementing a Change Champion Program. In this program, select employees help increase buy-in and reduce resistance to changes associated with M&A. Champions can help ease the transition of corporate culture changes and technical changes among their fellow employees.

M&A Can Be a Success

While the mergers and acquisition process can difficult, there is much to be gained. We firmly believe that success depends on people adopting the technology and cultural changes. Preparing a plan that helps anticipate and address challenges can be the difference between failure and success. At Core BTS, we have helped many organizations prepare for and successfully navigate M&A. If you’re looking for assistance with adoption and change management at your company, Core is here to help. Reach out to our team today to learn more about your options.

This blog was excerpted from their webinar on how to improve M&A outcomes. Click below to watch the full presentation.

Share on