share this

Business Situation

For nearly two decades, Philadelphia Federal Credit Union (PFCU) has partnered with Core BTS to help them advance their business technologies. Originally, we focused on providing PFCU with Cisco technologies and solutions for areas such as security, staffing augmentation, and data storage.

As part of our holistic approach, implementing long-term, technical strategies across a breadth of solutions is instrumental in delivering results to our clients.

In 2022, PFCU knew they were ready to begin their journey from on-premises to the cloud. Knowing we are also a trusted Microsoft partner, PFCU tasked us with preparing a licensing strategy that would allow them to capitalize on Microsoft’s cloud offerings.

"Working with Core BTS made everything easier.”

Rich Costello | IT Director | PFCU

Our Solution

Microsoft Licensing

Prior to engaging us to assist them in their cloud journey, PFCU had an existing Microsoft enterprise agreement that focused on supporting their on-premises infrastructure. Unhappy with their current Cloud Service Provider (CSP) and knowing they needed to make the transition to the cloud to stay competitive, PFCU turned to us for guidance.

COMPASS

To help create a strategic plan for their cloud journey, we took PFCU through our proprietary COMPASS program. This program is designed to help clients map out a strategy to gain control over their Microsoft portfolio and, in the case of PFCU, prepare them for their transition to the cloud.

1. Baseline Assessment

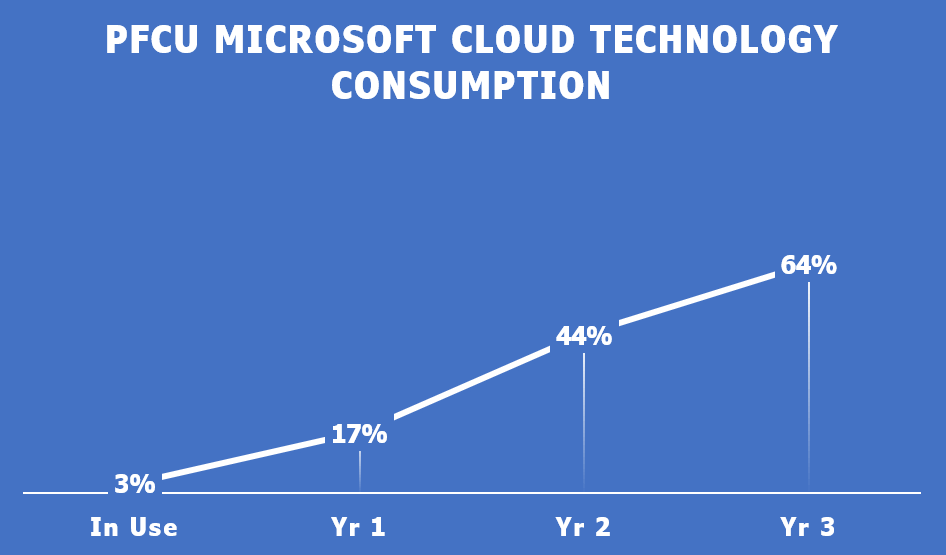

The first step within the COMPASS program is to create an analysis of the client’s existing Microsoft licenses. This analysis showed that PFCU was only utilizing 3% of the Microsoft cloud offerings they were paying for.

2. The Roadmap

After determining how PCFU could better utilize Microsoft’s cloud technology stack, we created a strategic plan that would gradually increase their cloud technology use over a three-year period. Following this plan would allow PFCU to increase their Microsoft cloud technology consumption from 3% to 64% by the end of the third year.

3. Technology Prioritization

Once the roadmap is in place and the client’s technology needs are determined, we help clients prioritize the implementation based on their needs and financial capabilities. For PFCU, rather than immediately adding all the new technologies at once, we planned for the gradual implementation over the three-year period. This allowed PFCU to strategically plan for these costs over a three-year budget, instead of paying a large sum up front.

Compliance

An important aspect of Core’s licensing services is ensuring that clients are compliant and won’t face costly fees following a Microsoft audit. To do this, our team worked in tandem with PFCU to review and compare the licensing they had installed versus what they were actually utilizing within their environment.

This comparison revealed that, like many companies, they had a surplus of licenses. We were able to help them streamline their active licenses and make their license agreement more efficient - which will provide them overall cost savings.

"Core BTS was incredibly responsive and worked closely with us to ensure we were taking the right next steps for our business.”

Rich Costello | IT Director | PFCU

The Results

Following the COMPASS assessment, PFCU followed Core’s advice and began implementing our Year 1 recommendations by purchasing several Microsoft licenses including:

- Visio Plan 1

- Visio Plan 2

- Enterprise Mobility & Security E5

- Office 365 E1

- Microsoft 365 Business Basic

- Project Plan 3

Additionally, strategically planning the implementation of their cloud technologies over a three-year period not only allowed PFCU to gradually incur the cost over time but will result in nearly 25% savings across the three years.

Philadelphia Federal Credit Union

Philadelphia Federal Credit Union (PFCU) was founded in 1951, originally to serve the financial needs of Philadelphia municipal employees. Today, PFCU is among the top ten credit unions in the area, serving the owners, employees, and directors of more than 400 organizations throughout Pennsylvania, New Jersey, and Delaware. PFCU provides for the financial well-being of its members through a dedicated and unique combination of professional and personal services. As a member-owned institution, PFCU invests daily in building one-on-one relationships with its membership community through uncompromising service, convenience, and a complete offering of competitive financial products and services.